BaFin's Proactive Mandate: The KYC/AML Blueprint for German Banks

Germany’s financial regulatory environment, guided by the Federal Financial Supervisory Authority (BaFin), is undergoing a profound transformation. In the aftermath of high-profile financial scandals such as Wirecard (2020), BaFin’s reputation suffered, and its previous approach was derided as too passive[1].

Today, BaFin has shifted from a reactive approach to a proactive, prevention-oriented stance. The regulatory body has enacted swift reforms (e.g. new task forces, more in-house expertise) and strengthened compliance initiatives through expanded powers and leadership changes[1].

Its strategic objectives for 2026–2029 double down on early risk detection, operational resilience, and aggressive enforcement of compliance standards[2]. Recent enforcement actions confirm a new urgency: BaFin is rigorously targeting not only overt financial crime but also fundamental organizational and technological failures within banks. The cost of non-compliance now extends far beyond fines to include operational restrictions, reputational damage, and loss of investor confidence.

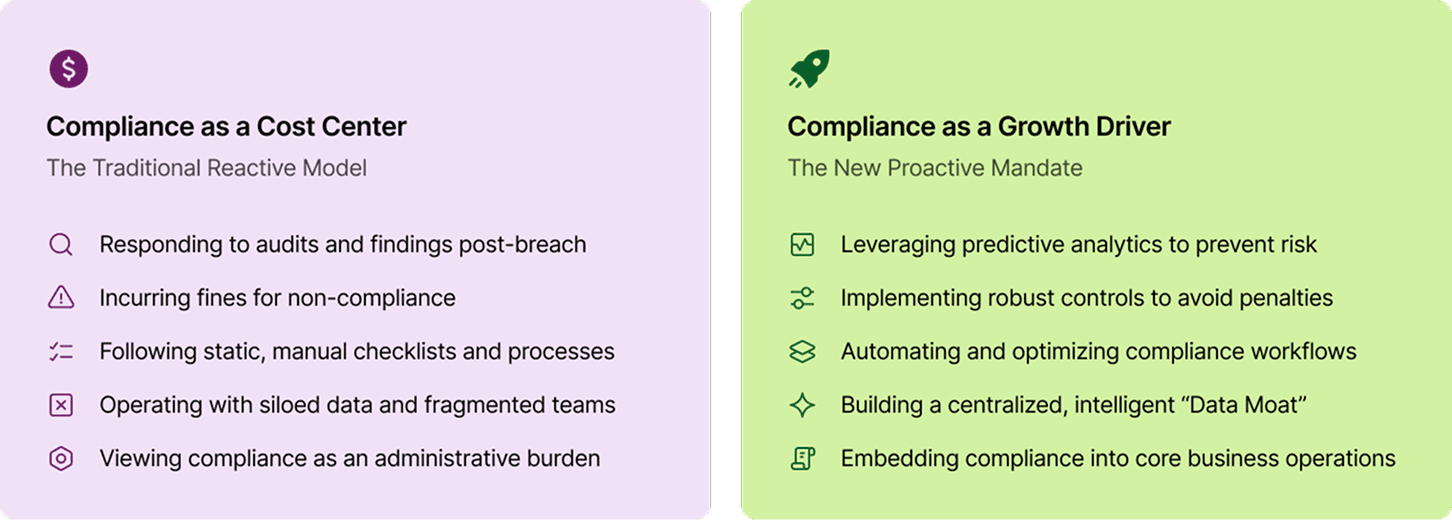

This shift has significant implications for banks operating in Germany. Public measures in recent years demonstrate that when governance and financial crime controls fall short, particularly at institutions with complex or cross-border models, BaFin is willing to escalate swiftly, including through growth limits, special commissioners, and capital add-ons [3][4][5]. In this environment, compliance can no longer be viewed as a “cost center” or afterthought.

Instead, compliance must be embraced as a proactive strategic function, with anti-money laundering (AML) and KYC software being core tenets of any financial services provider’s compliance umbrella. Forward-looking banks are beginning to treat robust compliance and RegTech (regulatory technology) adoption as sources of competitive advantage, instead of regulatory obligation. By investing in modern compliance infrastructure and regtech solutions such as automated KYC onboarding, AML monitoring solutions, explainable AI for risk decisions, data‑driven AML transaction monitoring, and workflow tools to reduce human error, banks can simultaneously satisfy regulators and improve business outcomes. This white paper details BaFin’s enforcement evolution and provides a blueprint for banks to modernize compliance.

In this new era, proactive compliance is not just a regulatory obligation; it is the foundation for survival, sustainable growth, and competitive advantage.

Request Access

We’ll email the whitepaper to you soon after verifying your details.

Written By Mohan Paranthaman

Nov 19, 2025